721 Exchange/UPREIT: Sophisticated Tax Deferral Strategy for Income-Producing Property Owners

A 721 exchange exercises a tax provision that allows for the non-recognition of gains when assets are contributed to a partnership in exchange for partnership interests. Leveraging an UPREIT, income-producing property owners may defer taxation of capital gain until partnership interests are redeemed for REIT shares or cash.

Shares of the REIT can typically be liquidated at designed times, in accordance with the terms of the REIT.

What is a REIT?

REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. These real estate companies have to meet a number of requirements to qualify as REITs. Some REITs trade on major stock exchanges, and they offer a number of potential benefits to investors.

What is an UPREIT?

REITs often hold their portfolio of real estate through an operating partnership, which structure is known as an Umbrella Partnership Real Estate Investment Trust, or UPREIT. This allows holders of real estate to exchange property for economic interests in the REIT in the form of OP Units of the operating partnership by contributing that property via a 721 exchange.

What is a 721 Exchange?

Internal Revenue Code (IRC) section 721 is a provision of the U.S. tax code that allows for tax-free transfers of income-producing real property to a real estate investment trust’s (REIT’s) operating partnership in exchange for ownership interests in the partnership.

How a 721 Exchange Works

A 721 exchange allows investors to contribute ownership in real property to the operating partnership of a REIT – the acquisition and ownership entity of the REIT – in exchange for units of limited partnership interests in operating partnership (OP Units).

Sell your property

Money goes into a DST for 2 years

REIT acquires the DST & investors receive OP units

12 months after DST is acquired

Monthly Liquidity

Exit at NAV

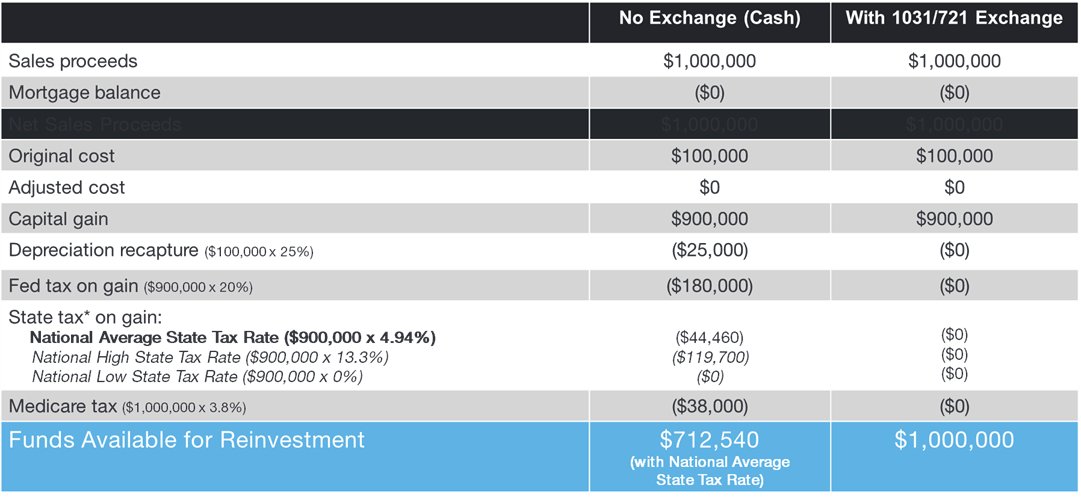

Hypothetical Property Sale Example

Potential Benefits of a 721 Exchange

Diversification: Access to an existing and growing portfolio of professionally managed, institutional-quality real estate diversified by asset classes and geography.

Income: An operating partnership that intends to provide regular income through an actively managed portfolio of income-producing properties. Distributions are not guaranteed and there is no guarantee that objectives will be met.

Capital Appreciation Investment Returns: Holders of limited partnership interests may experience appreciation of their invested capital if the value of the real properties in the portfolio rises.

Tax & Estate Planning: Heirs to limited partners may receive a step-up in the tax basis of their limited partnership interests, effectively eliminating the previously deferred U.S. Federal Income Tax on Capital Gains. Heirs have the flexibility to make individual decisions in respect to the sale of their inherited interests, whereas traditional heirs of investment property may require collective decision making.

Flexibility & Self Directed Liquidity: A redemption program for limited partnership interests may provide more liquidity than other forms of real property ownership and may allow owners to redeem interests in whole or in part, potentially managing periodic taxable gain recognition in alignment with specific financial goals and objectives.

This article was originally published by Inland Securities.