1031 Exchange Investment Strategies

Invest alongside leading institutional firms to complete your 1031 exchange. Access Delaware Statutory Trusts (DSTs), 721 Exchange REITs, oil & gas royalties, and custom exchange solutions — all designed for accredited real estate investors.

What is a Delaware Statutory Trust (DST)?

A Delaware Statutory Trust (DST) is a legal entity formed under Delaware law that holds title to real estate and allows multiple investors to own fractional interests in institutional-grade properties.

A Delaware Statutory Trust (DST) lets accredited investors complete a 1031 exchange while moving into a fully passive investment. DSTs are ideal for investors who want a stable monthly income without the burdens of property management.

With a DST, you own a share of a diversified portfolio of income-producing real estate. The properties are managed by institutional firms on your behalf. The DST structure is designed to shield owners from personal liability. Investors receive their portion of rental income, tax deductions, long-term growth potential, and estate planning benefits.

How DST Ownership Works

When you invest in a DST, you purchase a beneficial interest in the trust. The DST holds title to one or more income-producing properties — such as apartment communities, industrial warehouses, medical offices, or retail centers. An institutional sponsor manages the property on behalf of all investors.

As a DST investor, you receive your share of the rental income as monthly distributions. You also receive the tax benefits of real estate ownership, including depreciation deductions that can shelter some or all of your income. Because the DST is a pass-through entity, these deductions flow directly to your personal tax return.

Who Should Consider a DST?

DSTs are designed for accredited investors who want to:

Defer capital gains taxes through a 1031 exchange

Move from active property management to a fully passive investment

Diversify across property types and geographic locations

Access institutional-grade real estate, typically reserved for large investors

Simplify estate planning with easily divisible ownership interests

Key Benefits of DSTs for 1031 Exchanges

Can Be Diversified Across Multiple Properties or Portfolios

Investors Can Close Escrow in as Few as 1-3 days

Can be Diversified Across the Nation and by Asset Class

Structured to Provide Stable Monthly Income

Investment Amount Customized to Fit Exactly What is Needed

Non-Recourse Financing (If Debt is Needed)

How do I exchange a 1031 property into a REIT?

A 721 exchange, also known as an UPREIT (Umbrella Partnership Real Estate Investment Trust), is a tax-deferred transaction under IRC Section 721 in which an investor contributes property or DST interests to an Operating Partnership in exchange for units in a REIT.

A 721 exchange (also called an UPREIT transaction) allows investors to exchange their DST shares into a Real Estate Investment Trust (REIT) on a tax-deferred basis. This means you can move from a single DST property into a larger, more diversified REIT portfolio — without triggering capital gains taxes.

With a 721 exchange DST, investors first receive the benefits of a DST: tax deferral, stable income, and capital preservation. After a holding period, they can then access a more broadly diversified REIT. The REIT is structured to provide monthly income, additional growth potential, liquidity through a redemption program, and enhanced estate planning benefits.

How the 721 Exchange Process Works

The 721 exchange follows a two-step process. First, you use your 1031 exchange proceeds to invest in a DST that has a built-in 721 exchange option. You receive the same benefits as any DST investor — tax deferral, stable income, and capital preservation.

After a holding period (typically 2 to 3 years), you have the option to contribute your DST interest into the REIT's Operating Partnership. In exchange, you receive Operating Partnership (OP) units. These OP units give you access to the REIT's larger, more diversified portfolio.

DST vs. 721 Exchange: Key Differences

A standard DST investment lets you own a share of one or more specific properties. A 721 exchange DST starts the same way but adds a second phase: the ability to contribute your DST shares into a REIT. The REIT typically owns dozens or hundreds of properties across multiple asset classes and regions. This broader diversification is designed to reduce risk and provide additional liquidity through the REIT's redemption program.

The 721 exchange also preserves the step-up in basis at death. This means your heirs may be able to inherit the REIT shares and eliminate the deferred capital gains taxes entirely.

Key Benefits of 721 DSTs for 1031 Exchanges

Increased Return Potential from the REIT

Increased Diversification and Scale Intended to Reduce Risk

Reinvest Dividends at a Discount to Potentially Compound Returns

Access to the REIT’s Monthly or Quarterly Redemption Program

Ease of Divisibility of Shares for Estate Planning Purposes

Step-Up in Basis to Eliminate Past Capital Gains Tax for Heirs

Are Oil and Gas royalties eligible for 1031 exchanges?

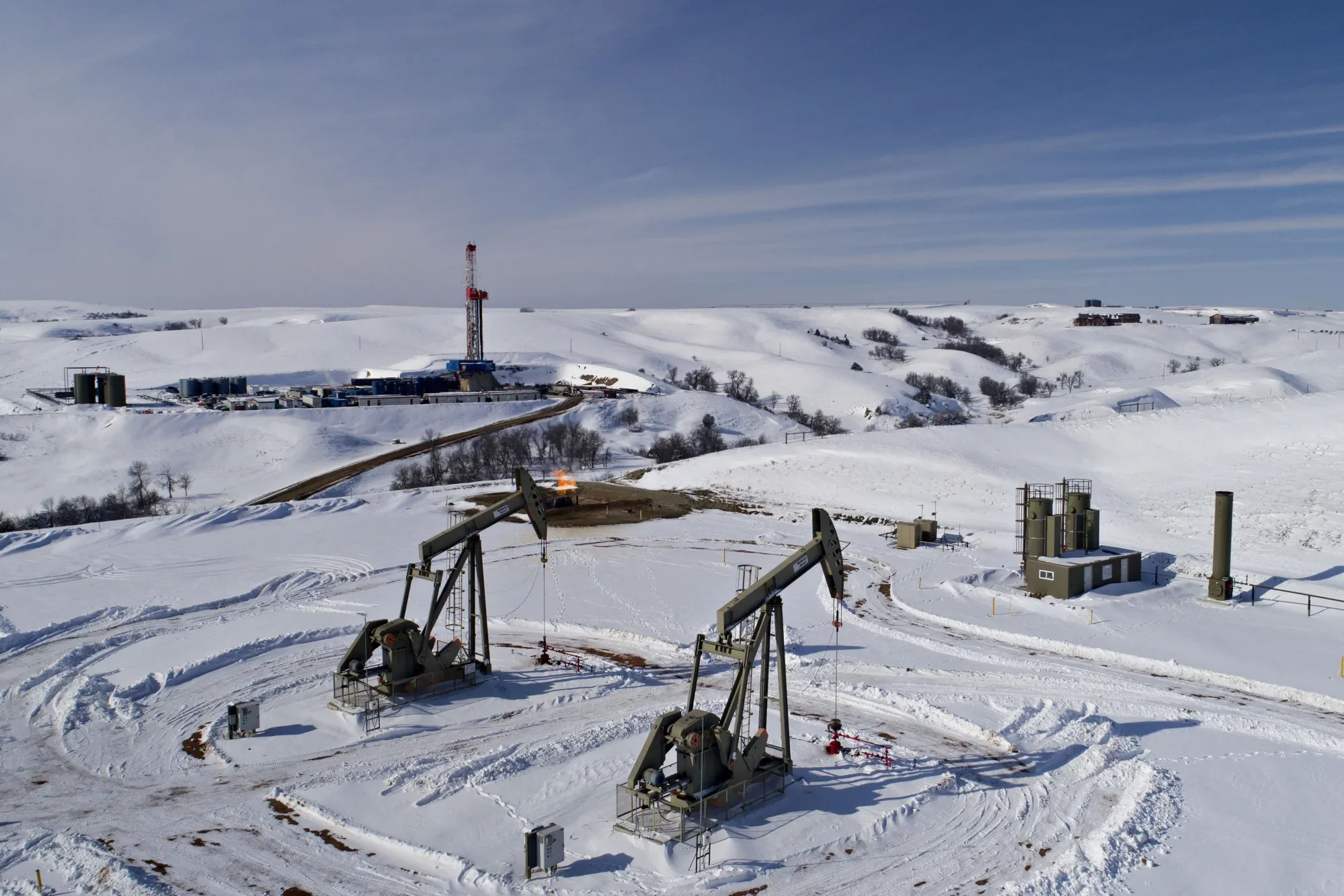

Oil and gas mineral rights are subsurface real property interests that entitle the owner to royalty payments when energy companies produce hydrocarbons from the land.

Oil and gas royalties offer a different path for 1031 exchange investors. Mineral rights are classified as real property under IRS rules. This makes them 'like-kind' to traditional real estate — and eligible for use in a 1031 exchange.

Mineral owners hold an interest in the subsurface real estate beneath a property. When energy companies drill wells and produce oil or gas, they must pay a royalty to the mineral owner. These royalties typically range from 15% to 25% of production revenue.

How Oil & Gas Royalty Income Works

When you purchase mineral rights, you become the owner of the subsurface estate beneath a piece of land. If oil and gas companies want to drill on that land, they must pay you a royalty — typically between 15% and 25% of the revenue from whatever is produced.

As the mineral owner, you are not responsible for any of the costs of drilling or operating the wells. The energy company bears all of those expenses. Your income arrives as monthly or quarterly royalty checks based on production volumes and commodity prices.

Risks and Considerations

Oil and gas royalties are tied to commodity prices and production volumes, both of which can fluctuate. If oil prices decline or wells produce less than expected, royalty income may decrease. Mineral rights are also less liquid than some other investments — selling a mineral interest can take time and requires finding a qualified buyer. As with all 1031 exchange investments, consult with your tax and legal advisors before making a decision.

Key Benefits of Oil & gas for 1031 Exchanges

Minerals and royalties can absorb any leftover exchange proceeds from the sale of your relinquished property. This helps you fully complete your 1031 exchange.

Many traditional real estate investors are looking for higher income. Mineral rights and royalties offer the potential for increased cash flow as oil and gas companies drill new wells on the property.

Royalty property owners are not locked into a shared ownership structure. Each owner controls their own holding period and exit strategy to fit their individual investment goals.

Minerals & Royalties have the potential to experience an acceleration in cash flow caused by the drilling of additional wells by oil & gas operators.

Private royalty ownership is a flexible 1031 exchange option. Whether you sell your property for $100,000 or $5,000,000, you can exchange the exact proceeds into oil and gas royalties.

Royalties and minerals let investors step away from traditional real estate. They offer diversification into a different asset class with exposure to different economic drivers.

Short-Term 1031 Exchange Solution: Customized Exchange Platform

Baker 1031 Investments' Customized Exchange Platform is a concierge investment service for high-net-worth investors with $5 million or more in 1031 exchange equity.

Our Customized Exchange Platform is designed for investors with $5 million or more in 1031 exchange equity. It provides sole-ownership investment options tailored to your specific exchange requirements. Targeted annualized cash flows range from 5.75% to 6.00%+, paid out monthly.

After 1-3 years, you are provided a no-obligation offer to acquire the asset(s) you select, with 1% appreciation per year on the value. This offer is intended to provide investors with the choice to participate in enhanced optionality, value, income, growth, liquidity, and estate planning options via a tax-deferred exchange into ExchangeRight’s REIT.

How the Customized Exchange Platform Works

The Customized Exchange Platform begins with a consultation. Our team learns about your exchange requirements, timeline, and investment preferences. We then present you with a selection of pre-vetted properties from our acquisition pipeline.

You choose the asset or assets that fit your goals. Our dedicated transaction team handles the acquisition, due diligence, and 1031 exchange coordination on your behalf. You take sole ownership of the property, backed by institutional asset management, accounting, and reporting.

After a holding period of 1 to 3 years, you receive a no-obligation offer to contribute your property into the sponsor's REIT. This offer includes 1% appreciation per year on the property value, giving you the option to access the REIT's broader portfolio, liquidity, and estate planning benefits.

Key Benefits of The Custom Exchange Platform for 1031 Exchanges

Select From A Pre-Vetted Acquisition Pipeline

Concierge Transaction and 1031 Exchange Coordination

Annualized Cash Flows of 5.75% - 6.00%+ Paid Out Monthly

Access to the REIT’s Monthly Redemption Program

Enhanced Optionality and Flexibility at Exit

Institutional Asset Management, Accounting, & Reporting

Frequently Asked Questions about 1031 Exchange Strategies

-

A DST is a way for you to own a piece of large, high-quality real estate like an apartment building or warehouse. It is a "passive" investment, meaning professional companies manage the property for you while you receive monthly income and keep your tax benefits.

-

A 721 exchange (or UPREIT) lets you trade your DST shares for shares in a much larger portfolio called a REIT. This is done without paying capital gains taxes immediately. It is often the "final step" for investors who want to stop doing 1031 exchanges and move into a large, diversified fund.

-

Yes. The IRS views "mineral rights" as real estate. This means you can sell a traditional property and buy oil and gas royalties to complete your 1031 exchange. You get monthly payments when energy is produced without the need to manage any buildings.

-

Yes. For high-net-worth investors, we offer a Customized Exchange Platform. This concierge service finds specific properties just for you, gives you full control over the asset, and provides a clear plan to eventually move into a diversified REIT if you choose.

-

Real estate always has risks. These include the property staying vacant, the value of the building going down, or the investment being hard to sell quickly. Unlike a house you own alone, you cannot choose exactly when to sell a DST asset.